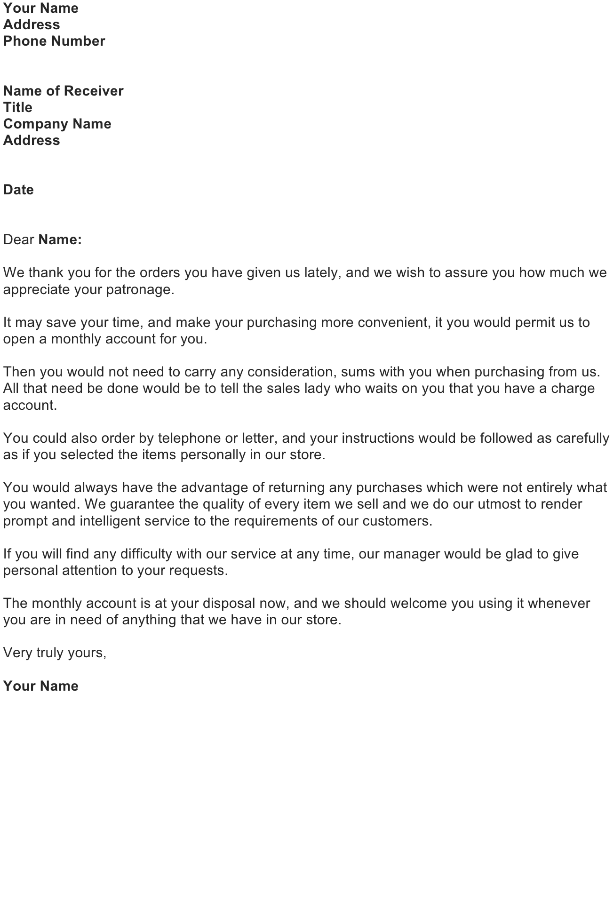

Credit Letter – Offer Monthly Account

Credit Letter Sample – How to write a credit letter.

A credit letter is a document issued by a bank to guarantee a seller will receive a buyer’s payment on time and with the correct amount. This is so that in the event that the buyer could not make the transaction himself, the bank will be able to cover the amount of the purchase made. In credit letters, there are three parties involved: the beneficiary or seller, the one who will be paid, the buyer or applicant, the one who purchased the goods and services, and lastly, the issuing bank, the one who issues the credit letter. Credit letters are usually used in international trade to ensure the payment wherein the buyer and seller does not know each other. They are a vital financial tool that you could use in facilitating trades.

Writing letters, reports, notes, among other things, are important skills for business and personal life. Good letters will yield nothing but good results. Most often than not, people assess others by the quality of their writing, hence it’s essential to write well. Here are some simple tips for writing credit letters to get you started:

• First and foremost, in writing a credit letter, you must be courteous in addressing the customer regardless if you allow the person a credit or not. Maintain a professional tone because it is vital to keep the customer’s trust.

• In the credit letter, you should list terms of the credit which both parties can be satisfied with. Be clear and precise with the information you put in the letter.

• If ever a customer is overdue in his payment, you should clearly state the consequences or penalties he will undergo.

Having a good business letter format or letter template as a guide can be very helpful. Download a free credit letter sample, then edit to suit your needs. It’s a great way to get you started in the right direction.