Letter to Accompany a Contribution to a Good Cause

Good Faith Letter Sample- How to write a good faith letter.

A good faith letter, or also known as goodwill letter, is a letter that aims to let you make repairs and amends to your credit report after previous mistakes. Mistakes may be late payments that you have failed to address due to financial problems. A good faith letter also serves the purpose if the overdue payment made to your account is incorrect or you are certain you have never made any infractions or late payments. An effective good faith letter is essential as it reverts your credit report to good standing.

Writing letters, reports, notes, among other things, are important skills for business and personal life. Effective letters will yield nothing but good results. Most often than not, people assess others by the quality of their writing, hence it’s essential to write well. Here are some simple tips in writing a good faith letter to get you started:

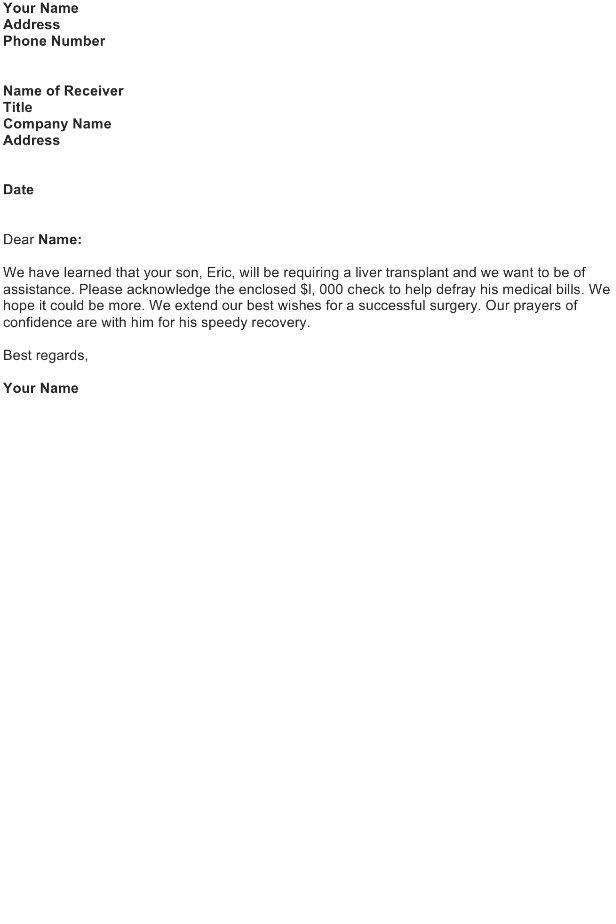

Having a good business letter format or letter template as a guide can be very helpful. Download a free good faith letter sample, then customize it to suit your needs. It is a great way to get you started in the right direction.